Most people know that any type of moving violation is likely to result in an increase in your auto insurance. What you might not realize is just how much of an impact that incident can have and how long you’ll be paying for that mistake.

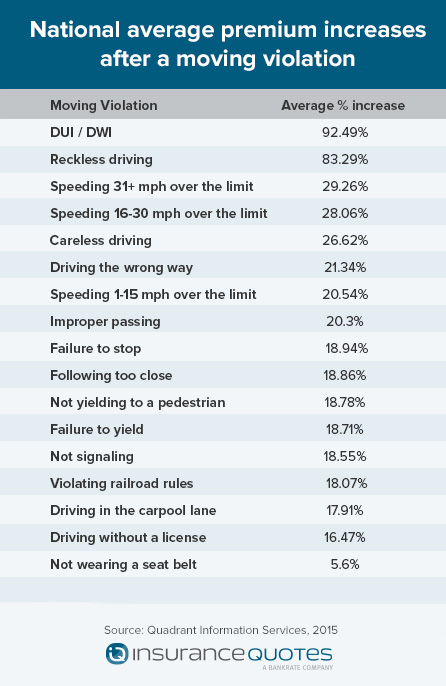

Insurancequotes.com commissioned a study to look at the way a moving violation affects insurance rates across the country. The study tracked rate increases for serious infractions like DUIs (driving under the influence), DWIs (driving while impaired/intoxicated), reckless driving, traveling more than 30 mph over the speed limit and improper passing, as well as minor violations like not signaling, driving in the carpool lane without the correct number of passengers, driving without a license or not wearing a seatbelt. How much of an increase you’ll see really depends on where you live and the type of violation.

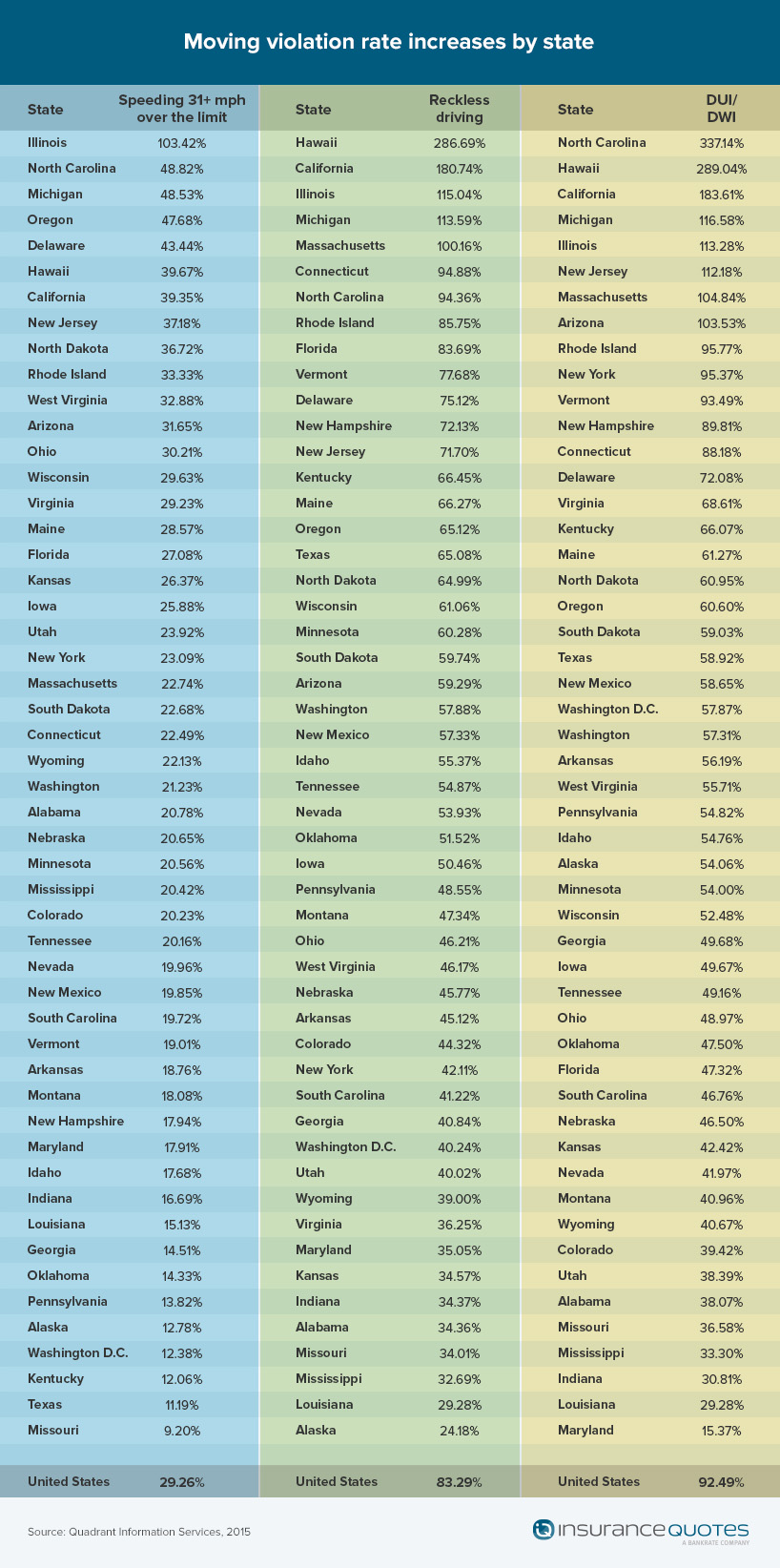

Insurers are more likely to substantially increase rates for higher risk violations like DUIs in which the likelihood of bodily injury or even death is significant. Although the average increase for a DUI/DWI is 92%, drivers living in North Carolina are likely to see the highest increases at 337%, followed by Hawaii at 289% and California at 184%. Michigan (117%), Illinois (113%), New Jersey (112%) and Massachusetts (105%) also are in triple digits when it comes to increases. Maryland had the lowest increase for a DUI arrest, coming in at just 15%.

A look at the actual number of DUI arrests shows that these states don’t have the highest arrest rates for their populations. In 2014, North Carolina had 49,599 DUI arrests or less than 0.51% of its population. Hawaii had 5,812 arrests, 0.42% of its 1.3 million population, and California had 214,828 (0.5%), but its state population is 37.6 million. Wisconsin had the highest number of DUI arrests, 40,549, for its 5.7 million residents, but a violation there will increase insurance premiums by only 52%. In Arizona, 0.61% of its 6.4 million residents were arrested for DUIs and saw their rates increase by 103%.

The increases for reckless driving were slightly less, but not much. Hawaii residents can expect to see their insurance increase by 287% after a reckless driving violation. California drivers could see as much as a 180% increase and Illinois drivers 115%. Even the states with the lowest percentages like Alaska (24%) and Louisiana (29%) saw double-digit increases.

If you happen to have a lead foot, there will definitely be a rate increase, but not to the same extent as some of the other violations. Offenders charged with exceeding the posted speed limit by 31 mph or more saw increases ranging from a high of 103% in Illinois to a low of just 9% in Missouri. The majority of increases ranged from 29% down to 11%.

Why the disparity in rate increases? It depends on the information insurers can use to determine rates. “All states have varying rules and regulations on what insurers are allowed to do or not do with the rates in their states,” explains Laura Adams, senior insurance analyst for InsuranceQuotes.com. “Different factors will affect the rate.”

For example, California’s Proposition 103 places severe limitations on what information can be used to determine auto rates, basing them strictly on the insured’s driving record, the number of miles driven annually and the years of driving experience. Factors like credit scores, marital status, education and income do not come into play at all.

An offending driver can expect to pay increased rates for the next three to five years says Adams. “Each MVA has a limit on how long the violation can stay on your record. Most are at about five years. If you get a second violation within that period of time, the numbers could go even higher,” she adds.

Drivers who have moving violations on their license are likely to see a higher increase than if they file an actual claim. Adams says this is because moving violations are an indicator of risk and send a signal to the insurer that a driver may be a greater risk than originally thought, and companies insure against that increased risk. Drivers who file a claim will usually see an increase only if they are at fault. But insurers also know that when a driver files a claim, the chances increase that there will be a second one within a given period of time.

If you do end up with a moving violation on your record, there is some good news. Adams says that most states allow you to go to traffic school or take a defensive driving course, which will remove the points from your license for a minor violation. She advises that drivers go to a school in person or take a course online, which can cost as little as $25. “Once you complete the course, the points will be removed from your license and that’s the red flag to the insurer.” If you take action quickly enough, it’s possible that the points could be removed before the insurer is even notified.

Adams also advises drivers who see an increase on their insurance after a violation to consider looking at other insurers. “Every company has their own algorithm that they use. If you have an increase after a moving violation, that’s the time to shop for another company, since each company factors it differently.”

Source: PropertyCasualty360