A new survey released today by insuranceQuotes finds that millennials are most likely to rent homes, but very few are covered by renters insurance. And while coverage is not expensive, not having it could cause a huge financial hardship.

Sixty-six percent of 18- to 29-year-olds rent their homes, compared to just 37 percent of consumers overall. However, less than one-third of millennial renters have renters insurance, according to the survey by insuranceQuotes in partnership with Princeton Survey Research Associates International.

Sixty-six percent of 18- to 29-year-olds rent their homes, compared to just 37 percent of consumers overall. However, less than one-third of millennial renters have renters insurance, according to the survey by insuranceQuotes in partnership with Princeton Survey Research Associates International.

When asked why they don’t have a renters policy, 59 percent of renters in the 18 to 29 age group said that cost isn’t the primary reason. Instead, they believe it’s unnecessary because their property is secure (61 percent) or they don’t own enough personal belongings to insure (43 percent). And surprisingly, 41 percent said they’re avoiding renters insurance because they don’t understand the product.

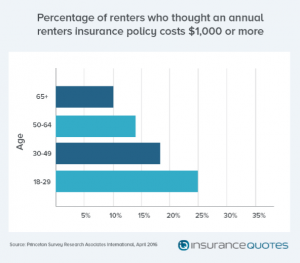

“A big takeaway from the survey is that many consumers underestimate the benefits of renters insurance and overestimate its cost. The average annual premium is $188; however, 25 percent of 18- to 29-year-old respondents believe they’d have to pay $1,000 or more. We need to educate a new generation of renters who don’t fully understand its benefits because it’s an affordable financial safety net that every renter should have,” says Laura Adams, senior insurance analyst for insuranceQuotes.

Other report highlights include:

- Renters who don’t have renters insurance because they don’t understand the product increased from 27 percent in 2015 to 33 percent this year.

- Renters who don’t have insurance because they don’t know where to get it also increased from 20 percent in 2015 to 26 percent this year.

- College graduates are more likely to have renters insurance compared to high school graduates or those with a lesser education – 64 percent to 24 percent respectively.

- Thirty-five percent of respondents mistakenly said a renters policy does not cover personal property damaged in a natural disaster or property stolen from you outside of your rental home (60 percent).

The full report is available at http://www.insurancequotes.com/home/millennials-and-renters-insurance-051916.

Methodology: The survey was conducted by Princeton Survey Research Associates International (PSRAI). PSRAI obtained telephone interviews with a nationally representative sample of 1,000 adults living in the continental United States.